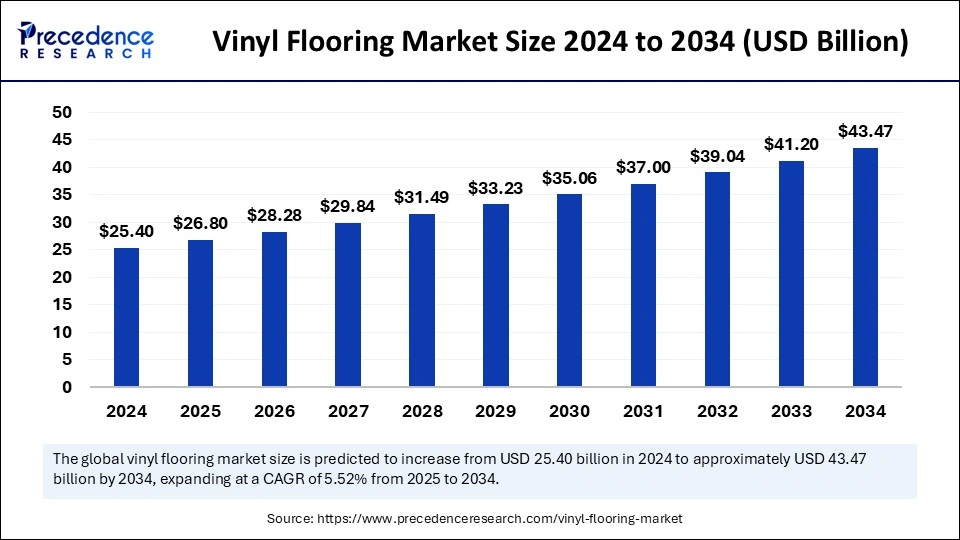

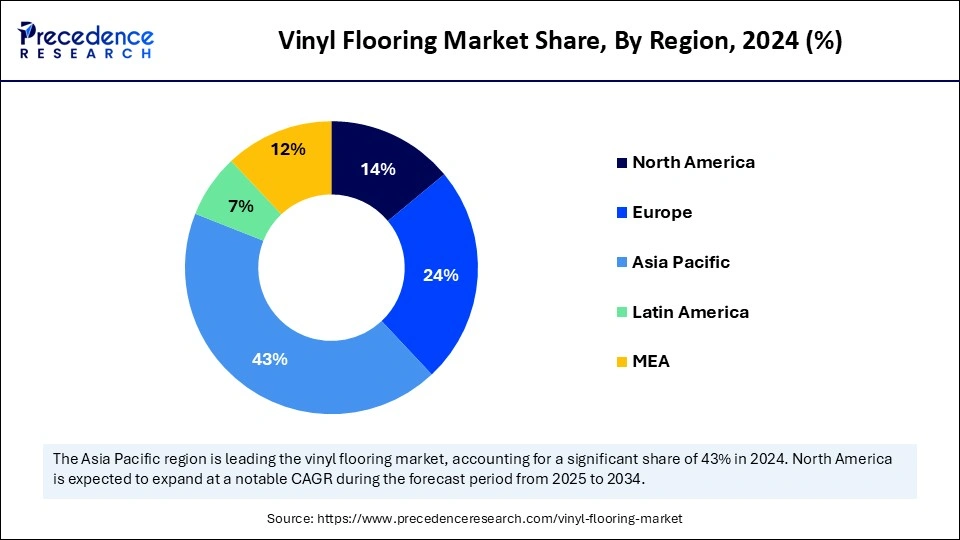

The global vinyl flooring market is set for significant expansion, growing from USD 26.80 billion in 2025 to USD 43.47 billion by 2034, at a CAGR of 5.52%. The increasing demand for aesthetic, durable, and cost-effective flooring solutions, particularly luxury vinyl tiles (LVT), is expected to drive this growth. Asia Pacific, leading with a 43% market share in 2024, will continue dominating, while North America is projected to expand at a remarkable CAGR of 13.9%.

Market Size and Regional Growth

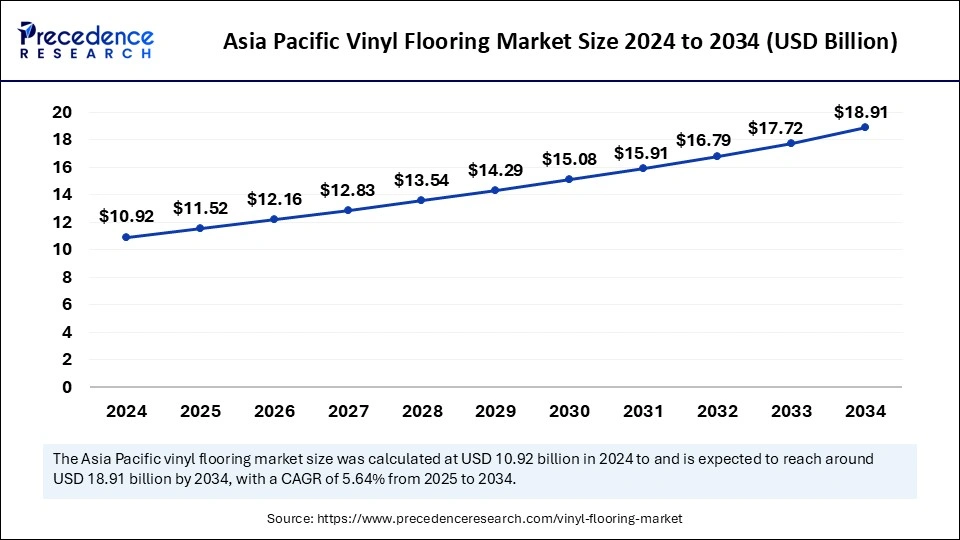

The Asia Pacific vinyl flooring market stood at USD 10.92 billion in 2024 and is expected to reach USD 18.91 billion by 2034, growing at a CAGR of 5.64%. Factors such as rapid urbanization, infrastructure expansion, and rising disposable incomes fuel market growth in this region. The demand for modern architectural flooring solutions in residential and commercial spaces is a primary driver.

In North America, the market benefits from a well-established service industry, expansion of the construction sector, and growing urbanization. The region saw $1.98 trillion in construction spending in 2023, contributing to the rising demand for vinyl flooring. The United States, particularly California, Florida, and New York, remains a key market with over 745,000 construction businesses operating as of 2023.

Key Market Segments

By Product:

- Luxury Vinyl Tiles (LVT): Held 65% of the market share in 2024, driven by consumer demand for high durability, easy installation, and aesthetic appeal.

- Vinyl Sheets: Expected to grow at a CAGR of 3.35%, favored for its cost-effectiveness and moisture resistance.

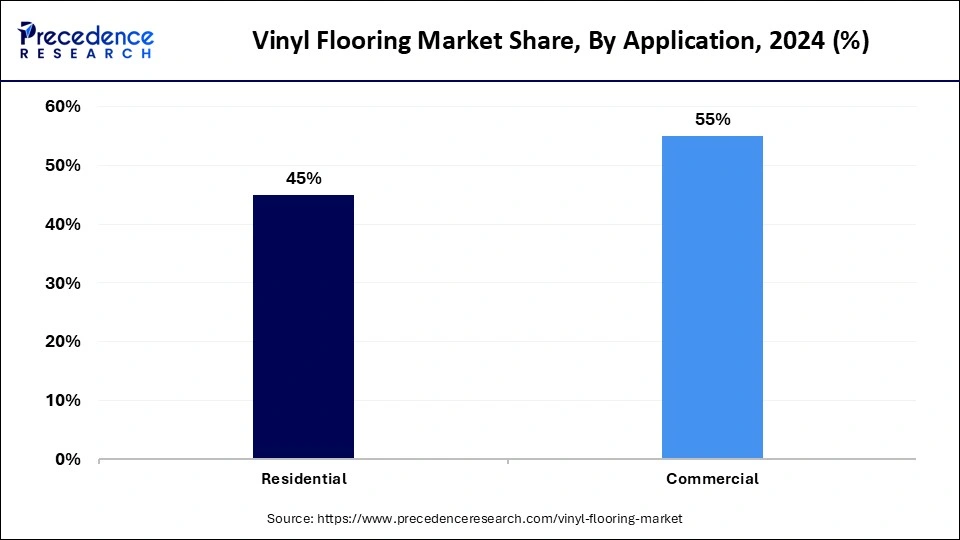

By Application:

- Commercial Sector: Dominated with a 54.34% market share in 2024, due to its popularity in offices, hotels, retail spaces, and healthcare facilities.

- Residential Sector: Witnessing a surge due to rising urbanization and disposable incomes, with vinyl flooring increasingly being used in kitchens, bathrooms, and living spaces.

Market Growth Factors

- Increasing construction activities worldwide, particularly in emerging markets.

- Growing preference for sustainable and low-maintenance flooring options.

- Rising demand for Luxury Vinyl Tiles (LVT), which replicate natural materials like wood and stone.

- Technological advancements in vinyl flooring, such as digital printing for intricate designs.

Challenges and Opportunities

Restraints:

- Raw material price fluctuations impact overall production costs.

- Environmental concerns regarding PVC-based flooring may hinder adoption.

Opportunities:

- Growing focus on eco-friendly flooring solutions using recycled materials and low-VOC emissions.

- Advancements in digital printing technology, enabling highly customized and visually appealing flooring options.

- Expansion in emerging markets, particularly in Asia and Africa, where infrastructure development is booming.

Recent Developments in the Vinyl Flooring Industry

- January 2025: Nox Corporation signed an MoU with BASF Corporation to enhance resource circularity and sustainability in LVT production.

- September 2024: Southern African Vinyls Association (SAVA) launched a vinyl floor recycling program to promote environmental responsibility.

- November 2024: Danube Home introduced an expanded flooring collection in the UAE, catering to residential and commercial markets.

Leading Vinyl Flooring Companies

- Congoleum Corporation

- Novalis Innovative Flooring

- Gerflor

- Mohawk Industries, Inc.

- Tarkett S.A.

- Mannington Mills, Inc.

- Armstrong Flooring, Inc.

With increasing investments in infrastructure, rising consumer demand for durable flooring, and a shift towards sustainable materials, the vinyl flooring market is set to experience robust growth through 2034.